Okay so the title is a bit sensational. This post begins the series I am doing on our domestic budget. Our income statement. Our ledger of income and expenses. Robert Kiyosaki’s books are all about teaching the average individual to read an income and expense statement. For individuals, sources of income can be royalties from books, photographs, articles, patents, licensing agreements, businesses, traditional employment, self employment, unemployment, etc. Expenses are in the form of credit payments, housing, utilities, etc. For the US government the income piece is a whole new ball of wax as is the expense piece, but an income statement is an income statement and they are all read the same. Fortunately for us, we live in a democracy, information is abundant and in many instances free. The government is not out to hide anything. The information that I am going to present is available for free from the GAO (General Accounting Office) and the Treasury. I will also use documents from the SSA (The Social Security Administration). The original transcripts and testimony from when Social Security was first established are available on that site! Imagine documents 75 years old available for all to see.

There are a couple of very important things to understand about Social Security.

1) At the time of the Great Depression there were no social safety nets

2) People who were self employed or owned businesses were just as likely as people who had been employed all of their lives to be unable to provide for themselves in retirement

3) People attempted to provide for their retirement through insurance vehicles (think something similar to whole life) but the surrender rate was very high and very few policies made it to maturity.

Surrendering a policy means that the policy holder surrendered the policy to the insurance company in advance of their retirement in exchange for the return of premiums. This is like someone taking a loan against their 401K or spending their Roth contributions ahead of retirement.

4) Social Security payments were only intended to be sufficient to keep recipients out of the then popular “alms” houses. The amount of money required to do that in 1935 was $30 dollars US.

5) The designers of Social Security only guaranteed solvency of the system to 1980. They felt that the Social Security Trust Fund would become too large and therefore too much of a temptation for politicians to spend. They weren’t sure that social security would continue to be needed and they wanted future governments to determine a way to keep it solvent.

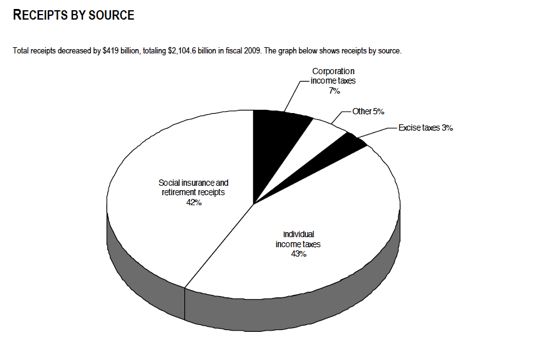

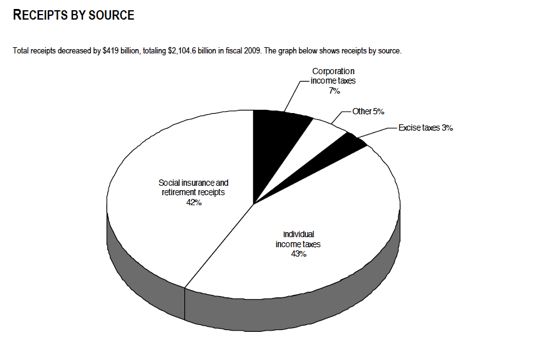

Now for the scary picture:

What do you see? Oh come on….don’t be shy! What do you see?

Well it is a pie chart. Taxes make up a chunk of revenue and so do Payroll Taxes collected to fund Social Security. So what! you are probably saying. Okay…drum-roll. Social Security revenues that are not immediately spent on Social Security payments to beneficiaries are spent elsewhere in government. It works like this:

5 dollars come in for Social Security. Only 1 dollar is converted to beneficiary payments, leaving 4 dollars in the trust fund. That 4 dollars doesn’t stay in the trust fund. Someone slips into the treasury in the dead of night, takes the 4 dollars and replaces them with an IOU. The 4 dollars are then spent as part of the general budget.

But don’t believe me. The follow excerpt is from page 11 of A Citizen’s Guide to the 2009 Financial Report of the U.S. Government by the Treasury:

“In addition to debt held by the public, the Government has outstanding nearly $4.4 trillion of

intragovernmental debt, which arises when one part of the Government borrows from another. It

represents debt held by Government funds, including the Social Security ($2.5 trillion) and

Medicare ($372 billion) trust funds. These Government funds are typically required to invest

any excess annual receipts in Federal debt securities. Because these amounts are both liabilities

of the Treasury and assets of the Government trust funds, they are eliminated in the consolidation

process for the Governmentwide financial statements. When those securities are redeemed, e.g.,

to pay future Social Security benefits – the Government will need to obtain the resources

necessary to reimburse the trust funds.”

What that gobledygook actually means is that when one part of government borrows from another, the transactions cancel so it doesn’t actually show up on the combined financial statement of the US government. It doesn’t mean the transaction (intragovernemental borrowing) never occurred. It just means they don’t report it on the balance sheet. Yikes! Will the government have the money when it comes time to make good on those IOUs? The short answer is probably not.

Again from A Citizen’s Guide to the 2009 Financial Report of the U.S. Government:

“Social insurance programs and Medicaid continue to represent a large share of Government cash-based expenditures. As reported in the Statement of Social Insurance (SOSI), over the next 75 years, the present value of expenditures for OASDI, Medicare (parts A, B, and D), Railroad Retirement, and Black Lung2, are, absent policy changes, projected to exceed dedicated receipts for these programs by almost $46 trillion (nearly 6% of GDP over the 75-year period). Medicare Parts B and D are financed by general revenues. By accounting convention, the general revenues are eliminated in the consolidation of the financial statements at the governmentwide level and as such are not included in this calculation even though the expenditures on the components are included.”

The important thing about this last paragraph is that Medicare Parts B and D are unfunded. The government has to find revenues in the general budget to pay those obligations. There are no funds that come into the government coffers that are earmarked to pay for Medicare Parts B and D.

A quick word about earmarks and I will close. About half of revenues that come into federal coffers are earmarked funds, funds that are designated to be spent for a specific purpose. The largest earmark is Social Security. There was a great deal of discussion during the Presidential Campaign about earmarked funds. The implication was that because funds were earmarked, they represented wasteful government spending. This was basically a misrepresentation of the truth. Eliminating earmarks would have put all Social Security revenues in the general revenue pool bypassing the need to track the revenues with IOUs making an already bad situation intolerable. The truth is that earmarked funds tend to be the most efficiently spent. The bad news is that any unspent earmarked funds are shifted to the general fund to address budgetary shortfalls elsewhere.

What do you think? Bad news? Good News? Please comment.

Twitter

Twitter Facebook

Facebook