If Image does not load, Click this link.

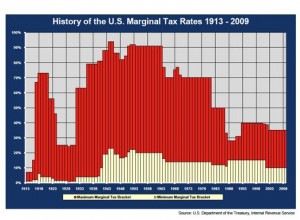

History of US Marginal Tax Rates

This graph is a gift from my Financial Adviser, Kim Butler of Partners4Prosperity. Tax rates are at their historic lows. The government has depended on a phenomenon called “bracket creep” to raise revenues. Bracket creep occurs when a work force receives regular increases in pay that result in broad movement into higher tax brackets. Most economic reports indicate that wages have been flat for the last decade, therefore tax revenues have been flat to declining. Bracket creep has not occurred. What, then, is going to happen? Taxes are going to have to go up…for everybody. Right now the government is playing the rich against the poor and middle class by promising benefits at the expense of those who should pay “their fair share”, the rich. But right now the rich, households making greater than $250,000, account for just 2% of the population. They can only be taxed so much.

Then what happens? Taxes must trickle down…to everyone.

And shouldn’t everyone have a hand in paying for the social safety nets we want to build? I believe it is important for everyone to decide what they want to pay for. If universal health care is a good idea, then it is a good idea no matter who pays for it.

It is pretty clear that taxes have room to go…up! So what do you want to pay for?

Please comment.

Twitter

Twitter Facebook

Facebook

{ 1 trackback }

{ 1 comment… read it below or add one }

Yes, taxes are going to go up. They have to.